We would have healthier and wealthier portfolios and economies.

We can drive change by diversifying who controls capital. When women share in the control of capital, better social and financial outcomes are the result.

More women in financial decision-making means more allocation to inclusive innovations, into undercapitalized opportunities, and prioritization of long-term growth.

When women are at financial decision-making tables, it leads to higher returns for individual investors and greater economic growth—a win-win for all.

Yet today 98% of allocated investment capital is managed by men4, barely 14% of private equity fund managers are women5, and less than 3% of venture capital is directed towards entities run by women6.

Data indicates that if we had achieved gender-balance in 95 researched countries between 2015 and 2025, we would have added $28 Trillion to the global economy7.

Backing women investors drives innovation and economic growth.

Women in venture capital drive different and more successful portfolios.

VC firms that increased the number of female partners experienced a 1.5% increase in fund returns each year, and 9.7% more of their exits were profitable8.

We also miss out on fueling more women-led companies. Female funders are 2X more likely to invest in start-ups with one female founder and 3X more likely to invest in companies with a female CEO9.

Women prioritize investing in sustainable solutions.

Environmental, social, and governance (ESG) is one of the fastest growing investment strategies, and women play a significant role.

One out of every three dollars under management in the United States—is managed according to sustainable investing strategies.

Research shows that female investors are almost twice as likely as their male counterparts to prioritize building portfolios of companies that integrate ESG factors into their policies and decisions.

Investing in and through women.

At WoWE investing in women changemakers at the nexus of environmental and social change is core to our thesis.

We are proud of our investments accelerating women capital allocators.

Urban Innovation Fund (UIF) is a venture capital fund investing in high-growth early-stage technology companies, with the potential to shape the future of cities. UIF is women-led with two General Partners, who have a proven track record of investing, mentoring, and exiting early stage, urban tech startups. WoWE invested in Urban Innovation Fund II in 2020. UIF II is delivering exceptional financial returns and strong impact outcomes with investment capital going to companies that have women founders or board members. 69% of founding team members and 56% of the boards of companies are women or people of color.

WoWE continues to fuel UIF’s women GPs, investing in their recently closed Fund III.

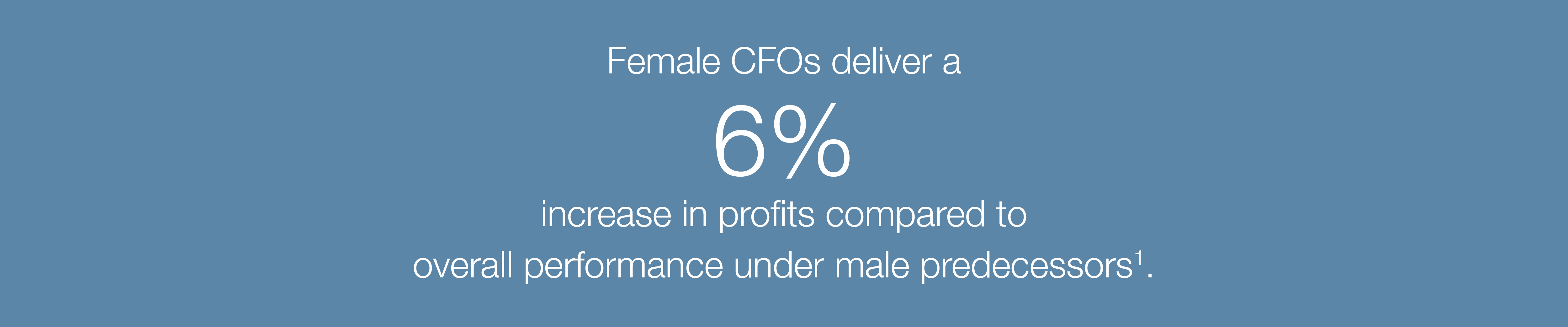

1. Sonali Basak and Jeff Green, “Female CFOs Brought in $1.8 Trillion More than Male Peers,” Bloomberg, October 16, 2019, https://www.bloomberg.com/news/articles/2019-10-16/female-cfos-brought-in-1-8-trillion-more-than-male-peers.

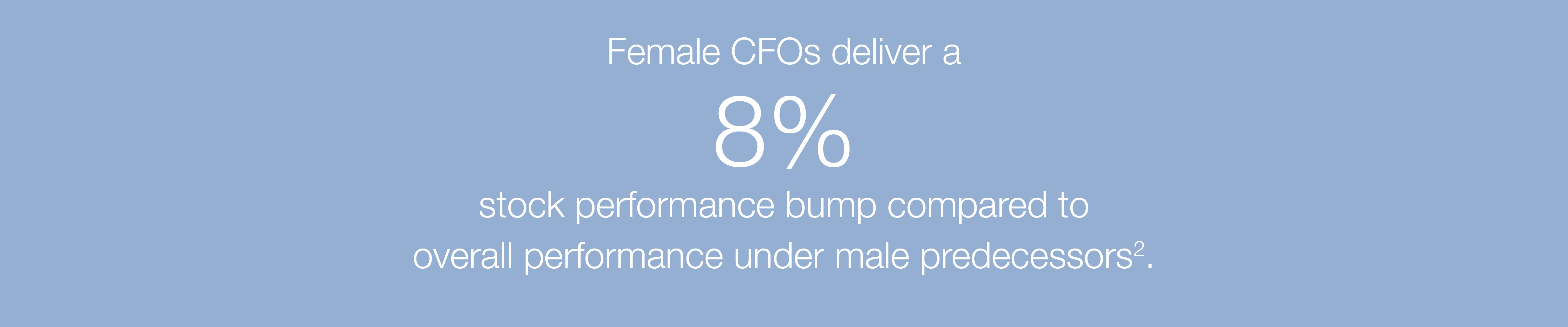

2. Ibid.

3. “Women in Alternative Investments: Building Momentum in 2013 and Beyond,” Rothstein Kass Institute, December 2012.

4. https://knightfoundation.org/reports/knight-diversity-of-asset-managers-research-series-industry/

5. “Women Make Up Just 14 Per Cent of Partners at UK Private” 235 Equity Firms and Hedge Funds,” Private Equity Wire, August 31, 2018, https://www.privateequitywire.co.uk/email/267911;

6. Karen Firestone, “When Will We See More Gender Equality in Investing?,” Harvard Business Review, March 25, 2019, https://hbr.org/2019/03/when-will-we-see-more-gender-equality-in-investing; “Venture Capital and Entrepreneurship,” Harvard Kennedy School Women and Public Policy Program,accessed December 18, 2021, https://wappp.hks.harvard.edu/venture-capital-and-entrepreneurship.

7. Jonathan Woetzel et al., “How Advancing Women’s Equality Can Add $12 Trillion to Global Growth,” McKinsey Global Institute, September 1, 2015, https://www.mckinsey.com/featured-insights/employment-and-growth/how-advancing-womens-equality-can-add-12-trillion-to-global-growth.

8. Gompers and Kovvali, “Other Diversity Dividend.

9. “All Raise All In: Women in the VC Ecosystem,” PitchBook, November 11, 2019, https://pitchbook.com/news/reports/2019-pitchbook-all-raise-all-in-women-in-the-vc-eco-system.